Among retail investors ("main street" investors as opposed to Wall Street), passive investing (i.e. investing through index funds and ETFs) has increased significantly over the past decades, at the expense of active investing (e.g. buying individual stocks). Estimates are that about 30% of the US stock markets is in passive investment funds - and that number is growing. Credit rating agency Moody's projected that by 2024 passive ownership supersedes active investment. Funds allow individuals with less assets to invest in the stock market by pooling money.

Theory says that shareholders are key to keep management on track. The proxy voting at companies' annual shareholder meetings are an important means: it gives shareholders the ability to let their voice be heard. That is the theory. But, passive investors are not supposed to be interested in the shenanigans of a particular company. Passive investing means riding the wave of the market: funds follow an index (a group of companies, determined by a certain algorithm). This is fine for investors as it is low-cost, and often low-risk, without terrible return on investment. However, if more investment is passive, how does this affect the stewardship role that shareholders are supposed to have?

Data

For purposes of shareholder engagement and transparency, US federal rules require each fund to vote at annual shareholder meetings and submit its voting records. For each year, the Edgar database of the US Securities and Exchange Commission (SEC) contains voting records of the largest funds.

By scraping the text files (see example) from the regulatory Edgar filings, I am building a several data sources:

- Shareholder activist trends since 2000.

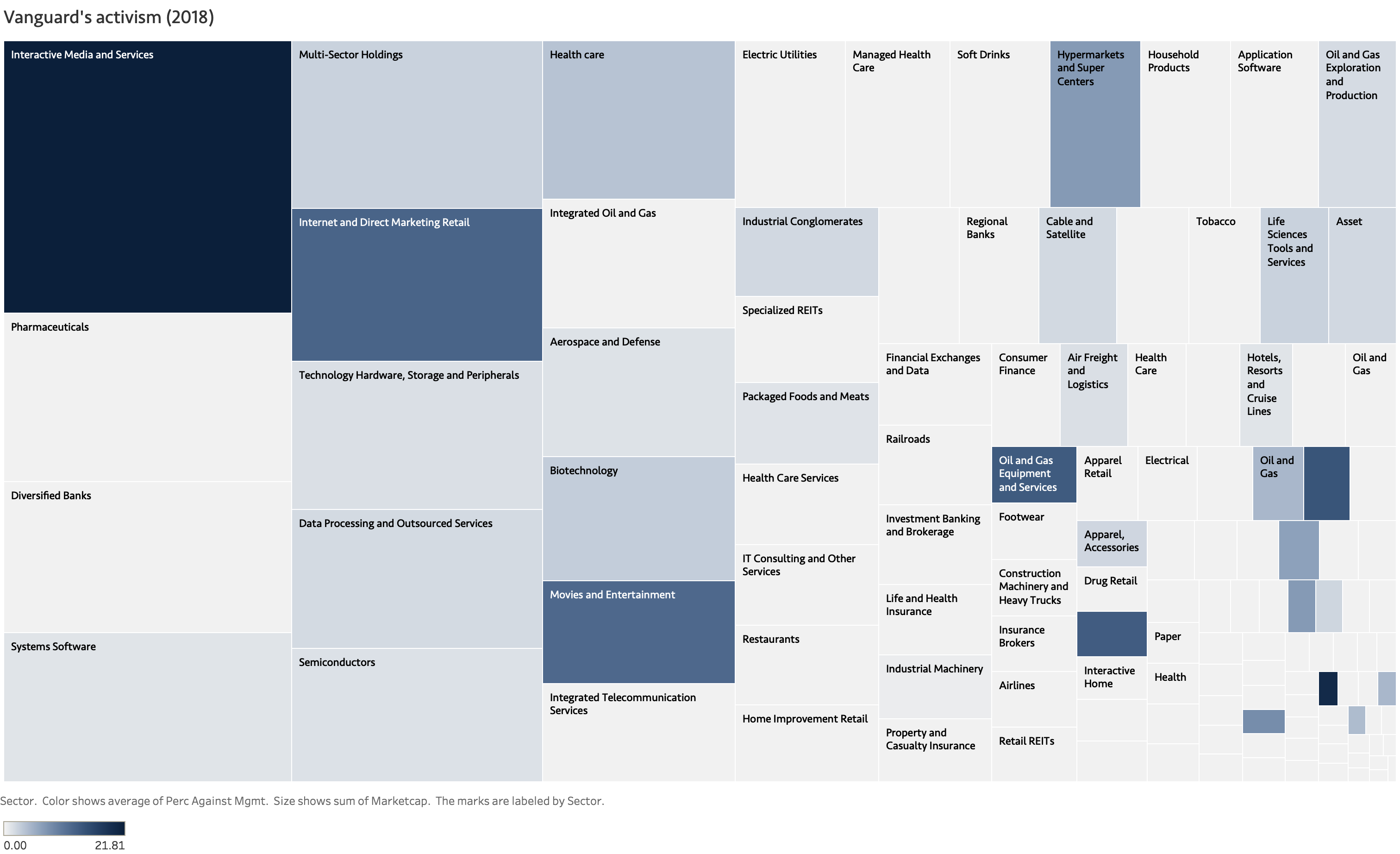

- In 3 separate data files: for the three largest fund providers, an overview of how they voted in the 2018 proxy season. Intent to expand this for the past 5 years (is 5 proxy seasons).

- For the last 5 years: overview of all proxy issues, for each SP500 company, voted upon by the 3 largest funds.

The aim is to identify trends in funds' shareholder engagement, and dissect activist tendencies in funds' voting patterns in terms of topic, sectors and company size (market capitalization).